Printable:0y9iyc0-_Qc= Budget Template

The “Printable:0y9iyc0-_Qc= Budget Template” serves as a pivotal resource for individuals seeking to enhance their financial acumen. This template not only facilitates the meticulous tracking of income and expenditures but also offers features that encourage strategic savings. As users engage with this tool, they may uncover insights that transform their budgeting approach. However, understanding how to maximize its potential and integrate it into daily financial practices raises important considerations that merit further exploration.

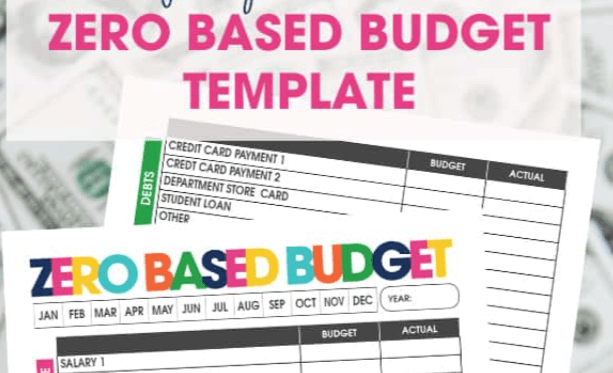

Overview of the Budget Template

The budget template serves as a foundational tool for financial planning, enabling individuals and organizations to systematically track income and expenses.

By categorizing budget items into distinct budget categories, users can gain insights into spending patterns.

Effective expense tracking through this template provides a clear overview of financial health, empowering users to make informed decisions and achieve their financial goals with confidence.

Key Features and Benefits

Several key features and benefits of a budget template enhance its utility for both personal and organizational financial management.

It facilitates effective expense tracking, allowing users to identify spending patterns and make informed adjustments.

Additionally, the template supports the development of savings strategies, empowering individuals and businesses to allocate resources wisely and achieve financial goals, thereby fostering a sense of autonomy and control over their finances.

Read also Printable:1fjxt1weqcc= Spiderman Face

How to Use the Template

Utilizing a budget template effectively can significantly enhance financial management practices.

Begin by implementing template customization to align the template with your specific financial goals.

Next, apply diverse budgeting strategies to track income and expenses accurately.

Regularly review and adjust the template to reflect changing circumstances, ensuring that it remains a dynamic tool for achieving financial freedom and stability.

Tips for Effective Budgeting

Effective budgeting is a cornerstone of sound financial management, and implementing key strategies can enhance its success.

Prioritize savings strategies by allocating a specific percentage of income for future goals. Simultaneously, utilize expense tracking to monitor spending patterns, identify unnecessary costs, and adjust accordingly.

This disciplined approach fosters financial freedom, empowering individuals to make informed decisions and achieve their financial aspirations.

Read also Board Says Set Back Promise Early

Conclusion

In conclusion, the “Printable:0y9iyc0-_Qc= Budget Template” serves as a vital instrument for enhancing financial management. By providing a structured approach to tracking income and expenses, it enables users to visualize their spending habits and identify areas for improvement. Despite concerns regarding complexity, the intuitive design simplifies the budgeting process, transforming financial chaos into clarity. Regular engagement with this template can foster responsible financial behaviors, ultimately guiding individuals towards their financial aspirations with confidence and precision.