Technology’s Contribution to Spend Management: A Layman’s Introduction

In today’s digital age, the way we approach finance has undergone a significant transformation. From individuals managing their expenses to businesses aiming for profitability and even non-profit organizations focusing on transparency, technology has emerged as the driving force behind modern spend management.

The Evolution of Spend Management

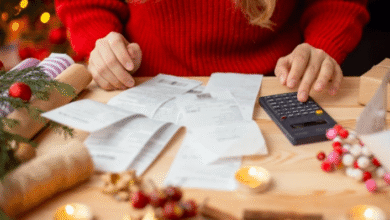

Traditionally, managing expenses involved manual record-keeping, paper receipts, and complex spreadsheets. The process was lengthy, tedious, and susceptible to errors. However, with the advent of technology, this landscape has evolved significantly.

Today, individuals and organizations leverage digital tools to streamline their financial operations. From budgeting apps to expense-tracking software, technology has simplified the way we manage our expenses. It has become the digital backbone of modern spend management strategies.

Benefits of Technology in Spend Management

Streamlining Financial Operations

One of the key benefits of technology in spend management is the streamlined efficiency it brings to financial operations. Manual tasks such as recording expenses and generating financial reports have been replaced by automated digital solutions.

Budgeting apps and expense-tracking tools offer users the convenience of real-time financial monitoring. They allow individuals to effortlessly track their expenses, set budgets, and keep a close eye on their financial health. For businesses, these tools enhance control over financial resources, promoting financial stability and growth.

Data-Driven Decision Making

Data analytics, powered by technology, plays a pivotal role in effective spend management strategy. By analyzing historical spending patterns, individuals and organizations can make well-informed financial decisions. Data-driven insights help in identifying trends, potential cost-saving opportunities, and areas where resources can be optimized.

This data-driven approach enhances the accuracy of financial decisions, aligning every spending choice with overarching goals. Whether it’s an individual saving for a dream vacation or a business making strategic financial decisions, technology provides the necessary data-driven support.

Industry Voices on Technology’s Role

Let’s take a moment to hear what industry leaders and successful entrepreneurs have to say about the transformative power of technology in finance.

Elon Musk, CEO of SpaceX and Tesla, notes, “Technology is the backbone of every financial move I make. From electric cars to space exploration, the efficient allocation of resources is made possible by harnessing data and technology.”

Oprah Winfrey, media mogul and philanthropist, believes, “In the non-profit world, transparency and trust are the bedrock of success. Technology has revolutionized how we ensure our donors’ contributions create meaningful change.”

The endorsement of technology’s role in finance by such influential figures underscores its significance in today’s world.

Challenges and Solutions

While technology has revolutionized spend management, there can be challenges in adopting and using these tools effectively. Ensuring data security, overcoming a learning curve, and managing software costs are some of the common hurdles.

However, solutions are readily available. Leveraging technology securely involves using trusted software and maintaining cybersecurity practices. As for the learning curve, many budgeting apps and expense-tracking software come with user-friendly interfaces and helpful tutorials. Moreover, the benefits of enhanced financial control and optimized spending often outweigh the associated costs.

Future Trends

The intersection of technology and finance is constantly evolving. Future trends indicate that technology’s contribution to spending management will continue to shape financial practices.

Emerging technologies such as artificial intelligence and machine learning are expected to play a more prominent role in financial decision-making. They will provide even more accurate data analytics, helping individuals and organizations fine-tune their spending strategies.

Blockchain technology will ensure greater transparency in financial transactions, benefiting businesses and non-profit organizations by building trust among stakeholders.

Mobile apps, particularly those focused on financial management, will become increasingly sophisticated and user-centric.

Conclusion

In conclusion, technology’s contribution to spend management cannot be overstated. It has revolutionized the way we manage our finances, offering streamlined processes, data-driven decision-making, and enhanced control over expenses. As we move forward, the role of technology in finance is expected to expand further, making it an exciting era for individuals, businesses, and non-profit organizations.

The adoption of technology-driven solutions is not without its challenges, but the benefits are significant. For those looking to achieve financial control, budget effectively, and make informed decisions, technology offers the tools necessary to embark on a successful financial journey.

FAQs (Frequently Asked Questions)

Q1: How to Begin with Budgeting Apps?

To get started with budgeting apps, visit your device’s app store, download a reputable budgeting app, create an account, and start tracking expenses and setting financial goals.

Q2: What Are Popular Business Expense Tracking Software?

Common business expense tracking software includes Expensify, Concur, and Zoho Expense. Choose the one that suits your business needs in terms of features and pricing.

Q3: Is Data Analytics for Everyone?

Data analytics isn’t limited to large corporations. Small businesses and individuals can also use data analytics tools to gain insights into their spending patterns and make informed financial decisions.