Understanding Financial Records in Bookkeeping 8139569973

Understanding financial records in bookkeeping is crucial for small businesses seeking sustainable growth. Accurate records provide insight into financial health and ensure regulatory compliance. Key statements, such as balance sheets and income statements, reveal performance trends and guide strategic decisions. By adopting organized practices and leveraging digital tools, businesses can enhance their financial management. However, the implementation of these strategies raises important questions about the best approaches to maintain clarity and efficiency.

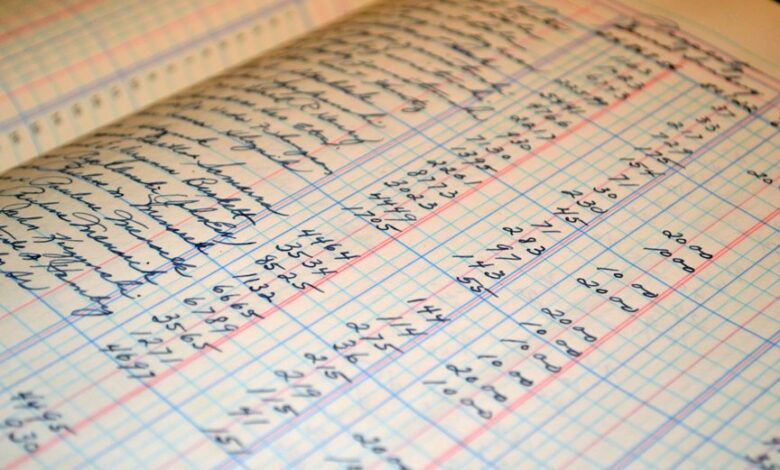

The Importance of Accurate Bookkeeping

While many businesses may overlook the significance of meticulous bookkeeping, it serves as the foundation for sound financial management.

Accurate bookkeeping ensures financial integrity, enabling organizations to meet compliance requirements effectively. By maintaining precise records, businesses can make informed decisions, assess their financial health, and foster trust with stakeholders.

Ultimately, diligent bookkeeping empowers entities to operate freely and responsibly in a complex economic environment.

Key Financial Statements Explained

Accurate bookkeeping lays the groundwork for understanding key financial statements, which are vital tools for evaluating a business’s financial performance.

These statements, including the balance sheet, income statement, and cash flow statement, enable comprehensive statement analysis.

Common Bookkeeping Practices for Small Businesses

Effective bookkeeping practices are essential for small businesses seeking to maintain financial stability and ensure compliance with regulations.

Implementing rigorous small business budgeting facilitates better financial forecasting, while diligent expense tracking helps identify cost-saving opportunities.

Tips for Staying Organized With Financial Records

Maintaining organized financial records is crucial for small businesses aiming to streamline their bookkeeping processes.

Implementing digital tools can enhance efficiency, allowing for easier tracking and sorting of financial data.

Establishing a system for record retention ensures essential documents are readily accessible while unnecessary clutter is minimized.

This approach fosters a clearer overview of finances, empowering businesses to make informed decisions and maintain autonomy.

Conclusion

In summary, maintaining accurate financial records is crucial for small businesses striving for longevity and success. By comprehensively understanding key financial statements and adopting effective bookkeeping practices, companies can navigate the complexities of financial management with ease. Staying organized not only simplifies compliance but also empowers informed decision-making. Ultimately, when it comes to financial health, businesses must remember that “a stitch in time saves nine,” underscoring the importance of proactive bookkeeping efforts for sustained prosperity.